The Simple

Expense Tracking App

For Contractors

Snap receipts, track job costs, and export tax reports instantly. No more shoeboxes full of faded paper.

What is Expense Tracking?

Expense tracking software lets you capture receipts and log costs instantly. For contractors, it ensures every bolt, screw, and hour of labor is accounted for, so you never undercharge for a job again.

With a TREVY subscription, expense tracking is integrated into your workflow. Buy materials at the hardware store, snap a photo in the app, and assign it to the client before you even walk out the door.

Whether you are a painter buying tailored colors or a carpenter with multiple supplier invoices, TREVY keeps your digital shoebox organized and your accountant happy.

Key Capabilities

- Snap & SaveTake a photo of your receipt on the spot. Never lose a tax deduction again.

- Job CostingAllocate materials to specific jobs to see your true profit margin.

- ReimbursementEasily add billable expenses to your client's final invoice.

- Cloud BackupYour digital receipts are safe forever, even if you lose your phone.

How to Track Expenses

Follow this simple workflow to capture receipts, organize costs, and be ready for tax time.

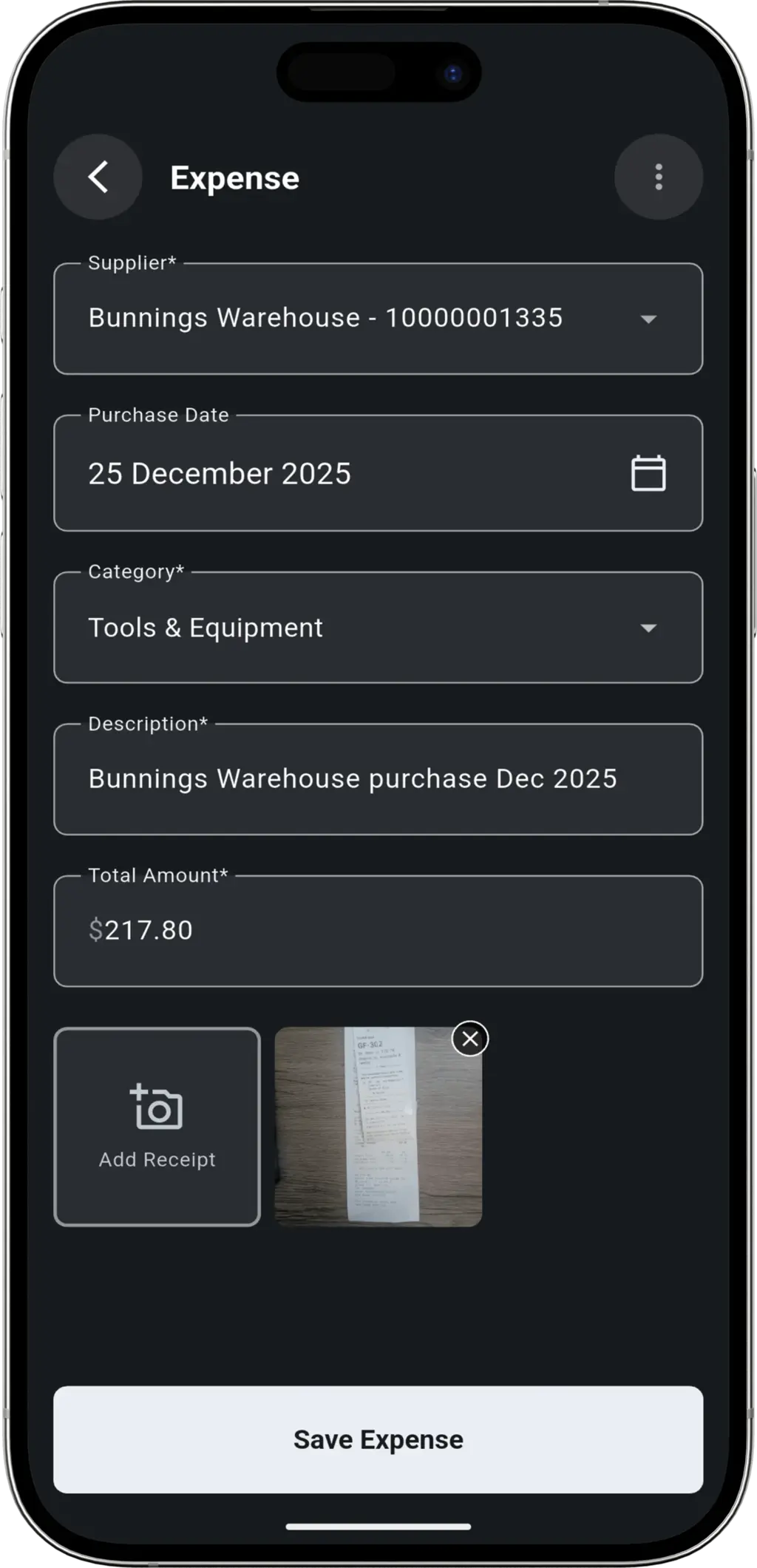

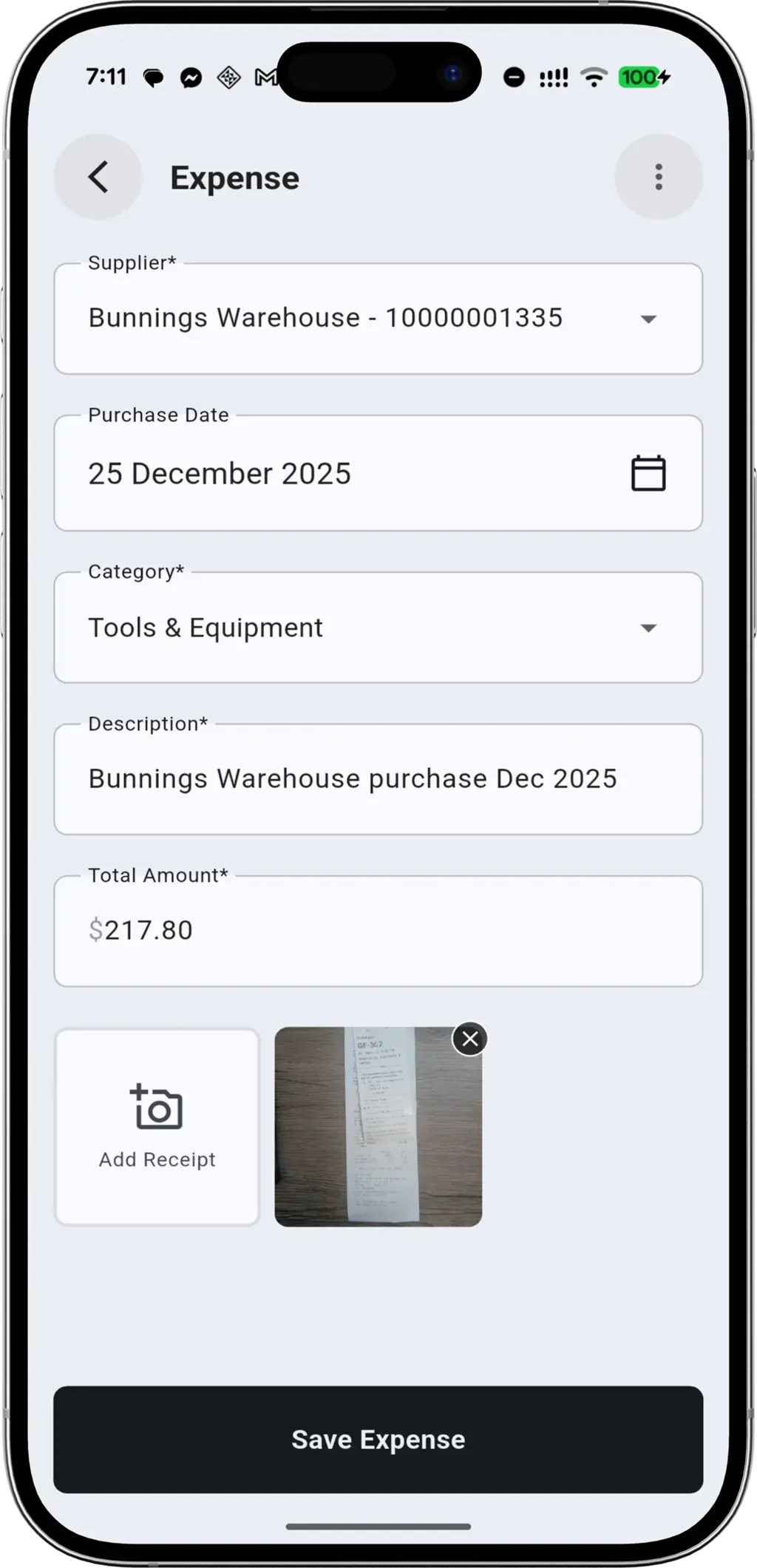

Snap & Save

You pick up supplies at the hardware store. Before you even leave the carpark, you snap a photo of the receipt with TREVY. It's safe, secure, and done. You can also create expenses directly from the job details screen to keep costs organized.

Organized & Searchable

Your receipts are instantly backed up to the cloud, categorized, and searchable. Need to find that paint purchase from three months ago? It's right there, linked to the client and job.

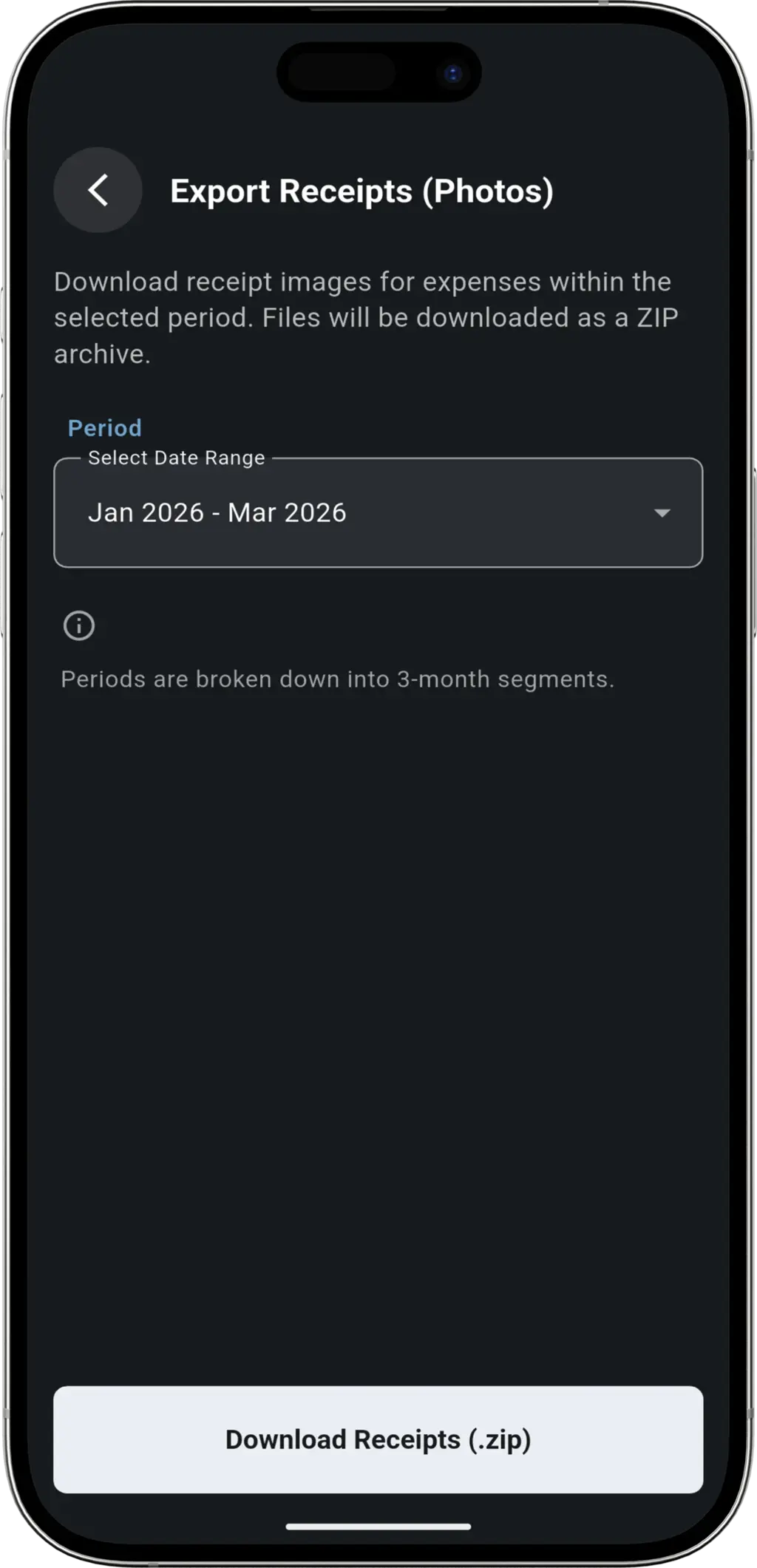

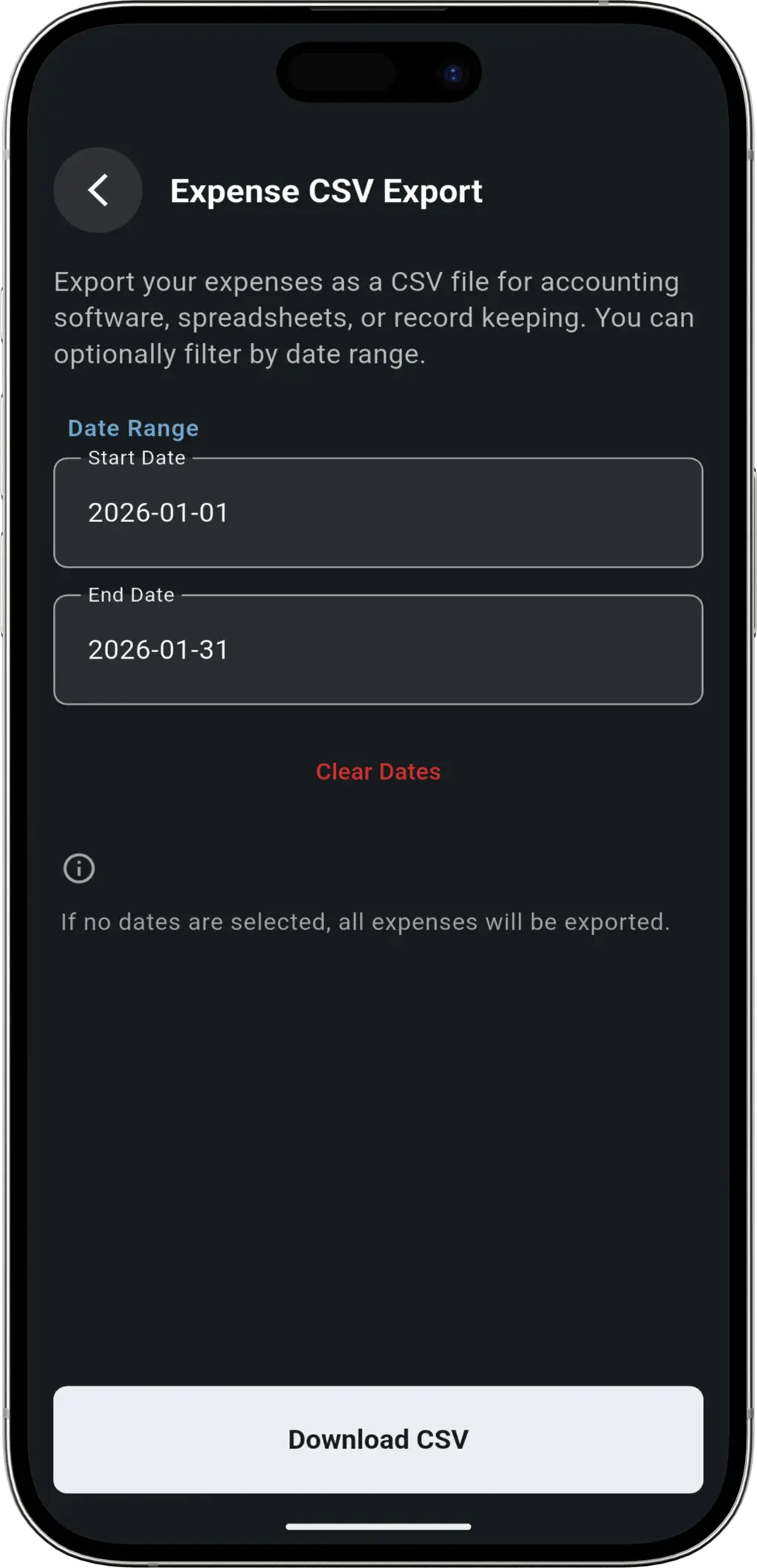

Tax Time Ready

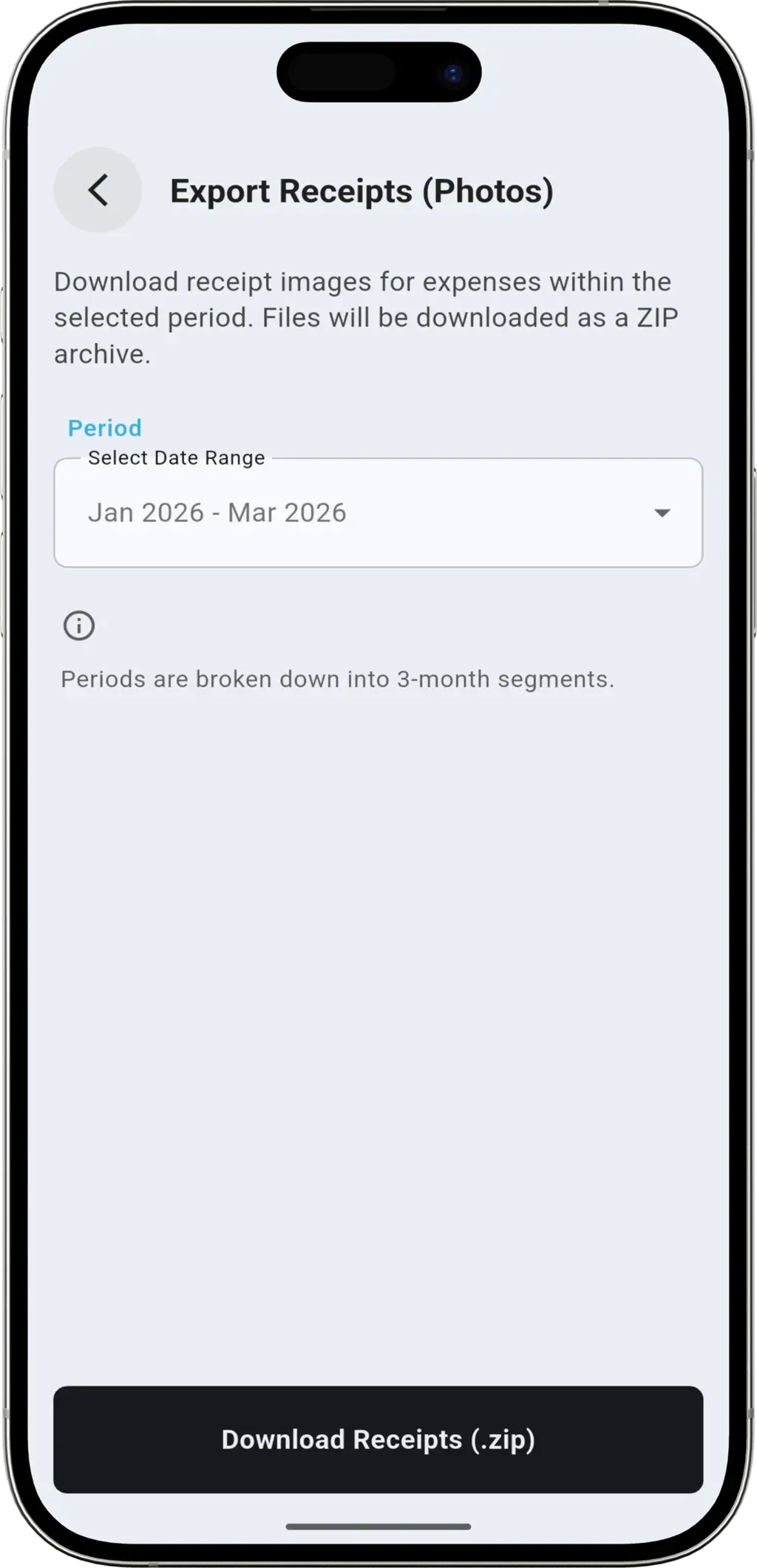

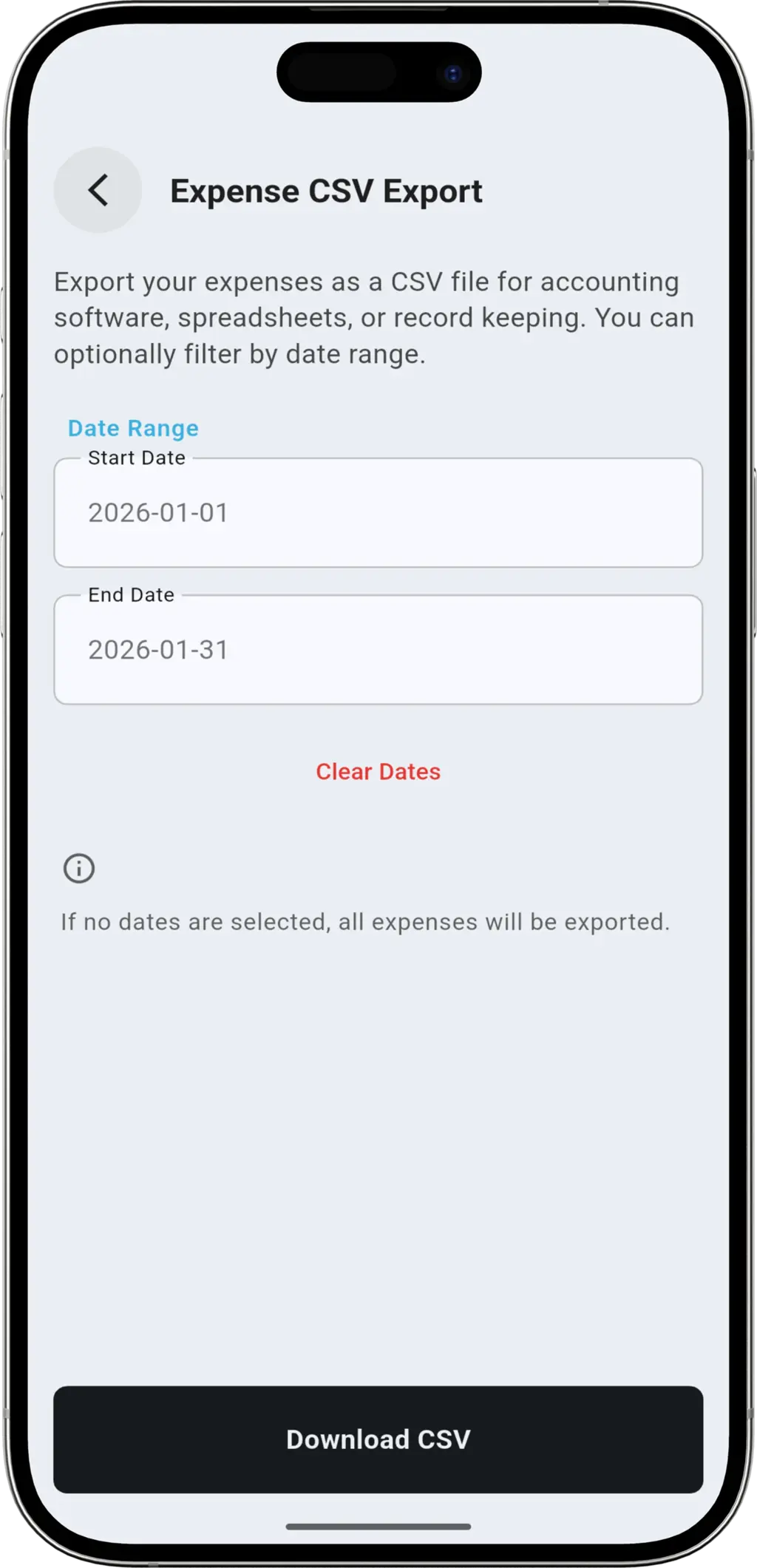

End of financial year? No panic. Export a full CSV report and download all your receipt photos with one click to email straight to your accountant. Maximum deductions, minimum effort.

Built for Owner-Operators

We don't overload you with accounting jargon. Every tool is designed for the contractor who needs to capture costs and move on.

Know Your True Profit

Link expenses to jobs and see your actual margin on every project. Stop guessing and start knowing.

All-in-One Platform

From the first quote to the final invoice, your expenses are connected. Stop juggling separate apps.

More Features

Everything else you need to run your business.

QUOTING

Quoting

Send professional quotes to your clients for review and approval. Receive instant notifications when a quote is accepted, so you can lock in the job and start working sooner.

JOB SCHEDULING

Job Scheduling

Send smart booking confirmations that allow customers to request better times, giving you total control over your dates. Manage your schedule with a simple day view that keeps you focused on the job at hand.

ON MY WAY

On My Way

Let clients know you are on the way to their property with a single tap. They'll receive a live tracking link to see your location in real-time, reducing missed appointments and anxiety.

PROFESSIONAL INVOICING

Professional Invoicing

Create professional, customisable tax invoices in seconds. Speed up billing by adding your saved services, offer instant payment links via Stripe, and look forward to even more templates coming soon.

CLIENT MANAGEMENT

Client Management

Keep all your client details in one secure place. Save company names, contacts, and multiple addresses. When you're ready to invoice, just select the client and we'll fill in the rest.

RECURRING JOBS

Recurring Jobs

Set up automatic recurring jobs for your regular clients. With support for Daily, Weekly, Fortnightly, and Monthly schedules, you can ensure your steady work is always booked in on time.

Expense Tracking for Every Trade

TREVY makes expense tracking easy for owner-operators across all industries.

Expense Tracking FAQ

Common questions about managing receipts and expenses.

In most countries (including the US, UK, Australia, and New Zealand), digital copies of receipts are fully accepted by tax authorities. As long as the photo is clear and readable, you can safely throw away the faded paper version.

Yes! You can instantly generate a detailed CSV report of all your expenses for any date range, plus download all your receipt photos. Perfect for sending to your accountant at tax time.

Absolutely. All your receipts and data are securely backed up to the cloud in real-time. Simply log in to TREVY on your new device, and everything will be there.

Yes. You can create expenses directly from the job details screen, making it easy to track material costs for each project and see your true profit margin.

By tracking your material costs against each job, you can ensure your invoice covers all expenses plus your margin. It's all connected.

Ready to grow your business?

Streamline your business admin. Save time and get paid faster with the app built for service pros. Download TREVY today.